For GST Reports it is mandatory to show the sale in the master units list published.

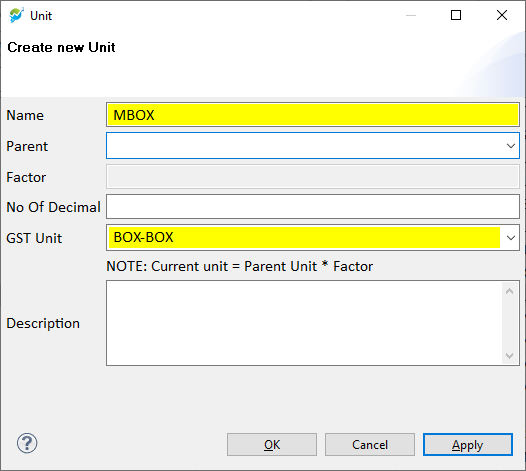

For every new unit, you create it is must to define the GST Unit

Similarly for alternate units, the mapping with GST Units should also be configured. We recommend using the GST units as alternate units, however you can use your own and map them with GST units.

Innoventry ignore the case of alternate units and match them with the GST units. E.g. if you choose Box as your alternate unit, then system automatically choose BOX-BOX as GST unit.

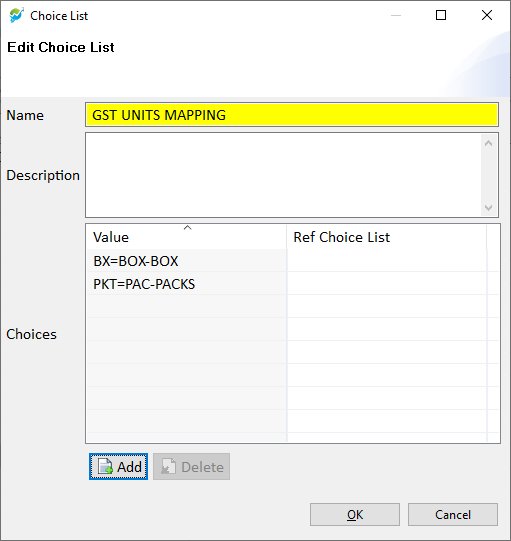

However if you choose BX to be your unit then you must map it with BOX-BOX Gst Unit. To do this perform following steps:

- Search for ‘GST UNITS MAPPING’ Choice List in Master -> More -> Choice List. If this choice list is not available, you can create new.

- For every unit to be mapped, create a choice in the format unit=gstunit. e.g. BX=BOX-BOX

Click OK to Save the setting.

GST Reports will now use this mapping.