Why Kerala Flood Cess #

Kerala Flood Cess is levied to raise the fund required for re-construction of State after the devastating flood occurred in the State during August 2018.

How to configure KFC in Innoventry #

Configuration of Kerala Flood Cess needs 4 high level steps:

- Create a new Tax called KFC

- Create a new Tax Group to use KFC

- Update Tax Class to use KFC

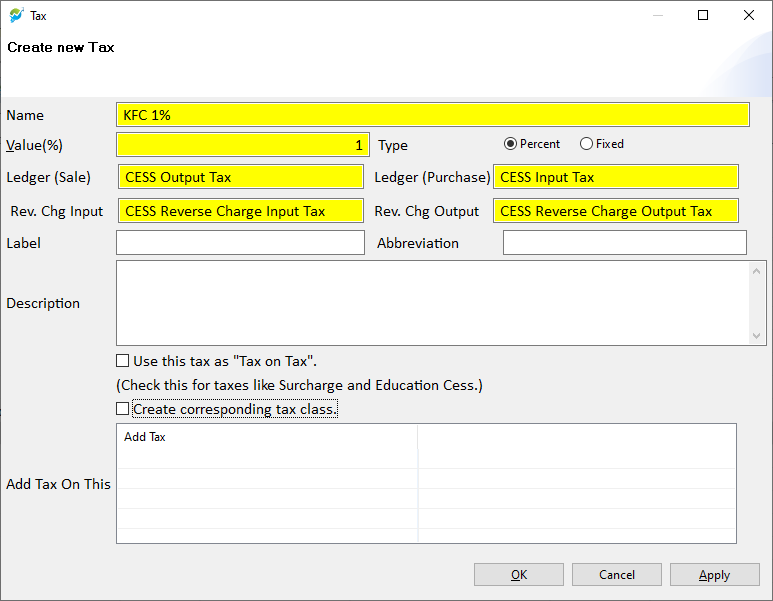

Create new Tax – KFC #

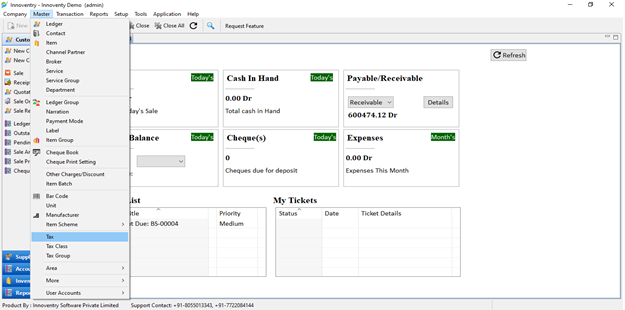

To create Kerala Flood Cess Tax, Go to Master -> Tax

Click on New button in toolbar to open the create tax dialog.

Fill the required information as shown below in the image.

Be sure to uncheck “Create corresponding tax class.”

Click on OK button to save the tax. New Kerala Flood Cess Tax is created successfully.

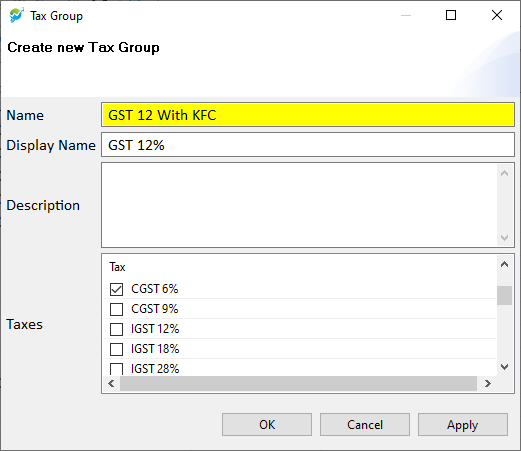

Create New Tax Groups to use KFC #

To update tax groups Click on Master -> Tax Group

Create New Tax Group Like- GST 12% With KFC.

Check CGST 6%, KFC 1%, SGST 6% in the taxes list.

Click on OK button to save the tax group.

Follow the same steps for other Tax Groups like:

- GST 18%

- GST 5%

- GST 28%

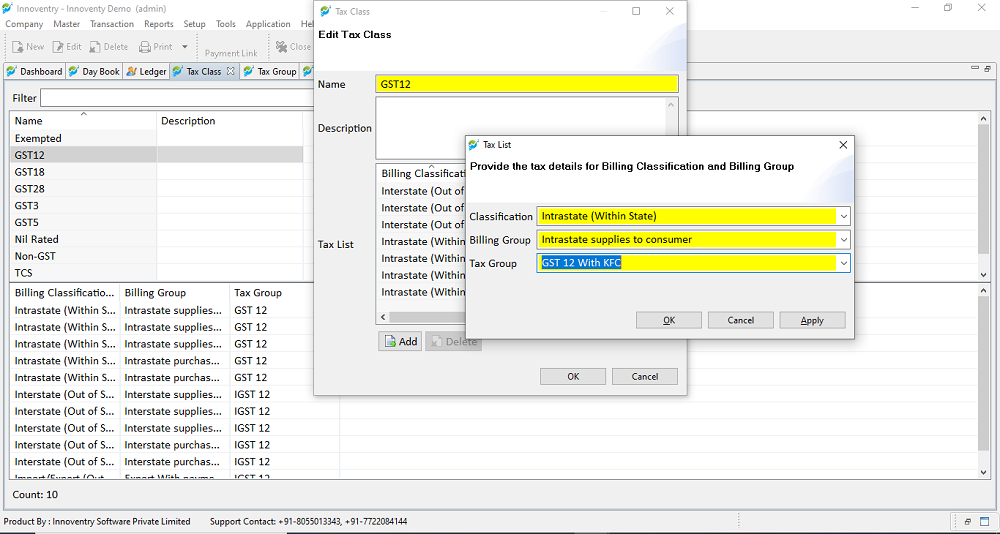

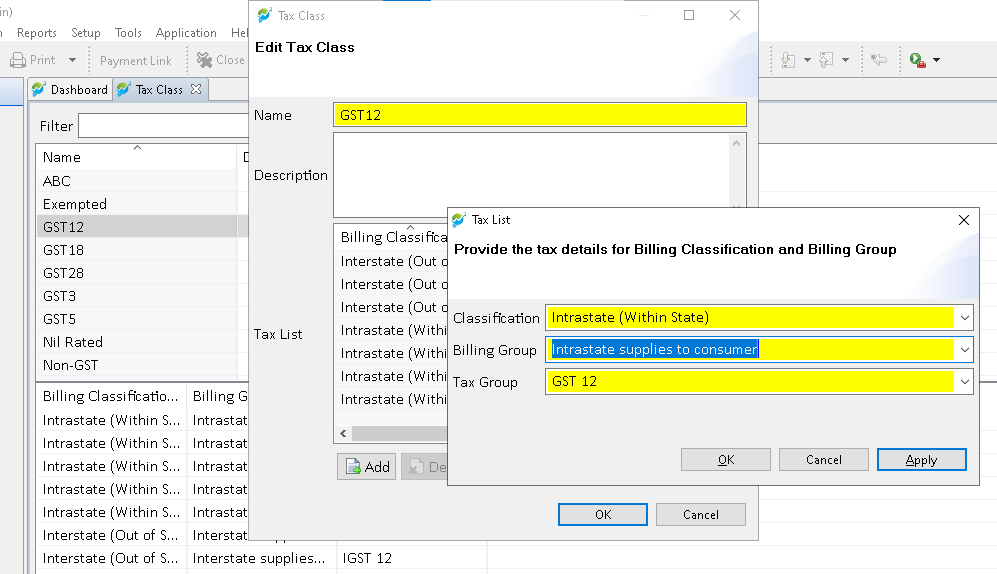

Update Tax Class to use KFC #

Edit Tax Class GST 12 %

Delete Intrastate supplies to consumer

After that Click on ADD Button & Select –

- Select Classification – Intrastate (Within State),

- Select Billing group – Intrastate supplies to consumer

- Select Tax Group – GST 12 With KFC

Click on OK button to save tax Class.

How to Remove KFC #

Edit Tax Class GST 12 %

Delete Intrastate supplies to consumer

After that Click on ADD Button & Select –

- Select Classification – Intrastate (Within State),

- Select Billing group – Intrastate supplies to consumer

- Select Tax Group – GST 12 With KFC

Press OK to Save the Tax Class

Repeat the same for other tax classes like GST18, GST28