TDS stands for Tax Deduction at source. This is a methodology implemented by the Government of India to collect tax in a regular and effective way from the taxpayers. TDS is a type of indirect method of collecting tax by the government. It is a sort of advance tax payment done to the Income Tax department. If the legit tax for the financial year is less than the TDS the tax payer can file for a IT return and get back the excess if any.

TDS can be performed by any authorized person or institution which takes responsibility to collect and pay the tax to the government. In lieu to the deduction of tax a TDS certificate is issued to the tax payer stating that the tax has already been paid by the taxpayer on his/her behalf.

So there might be a need to deduct taxes during transactions in the business. Innoventry has got you covered with the feature where you can enable tax deduction during the transactions like sale/purchase etc.

>>To enable Tax Deduction at Source follow the below steps: #

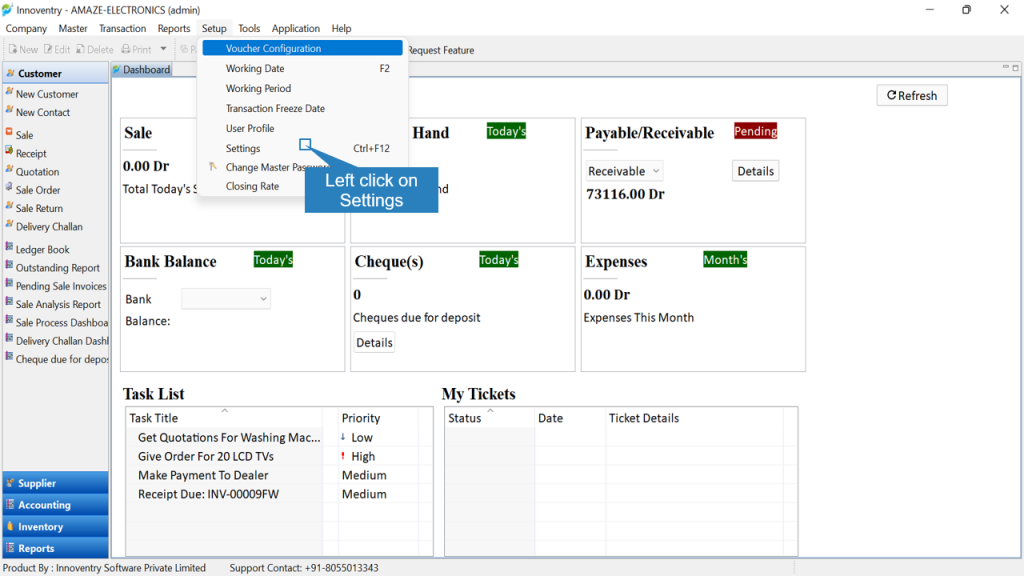

Step 1: Go to Setup > Settings.

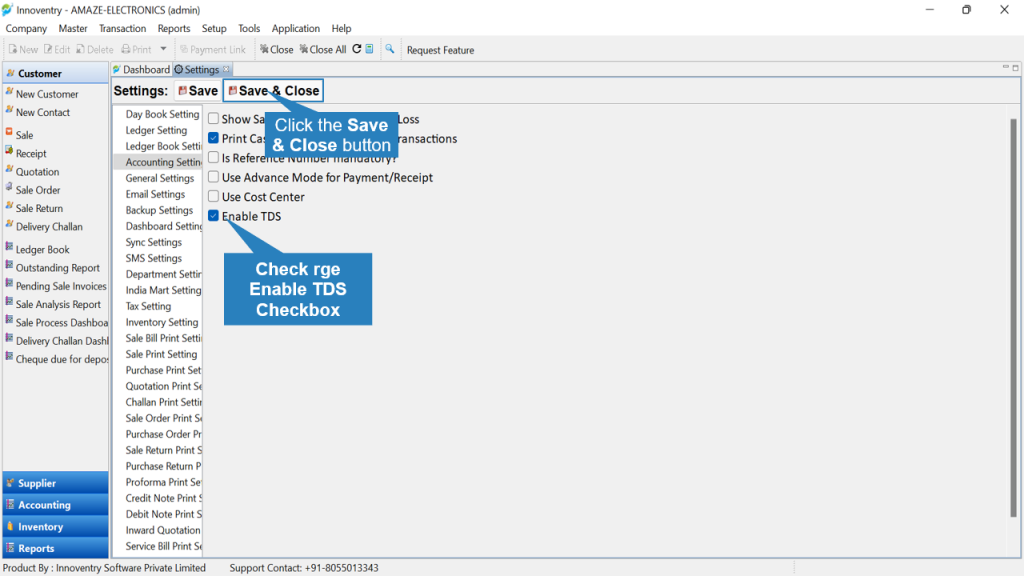

Step 2: Select “Accounting Settings” from the list of settings. Then check on the “Enable TDS” option and “Save & Close” the settings tab.

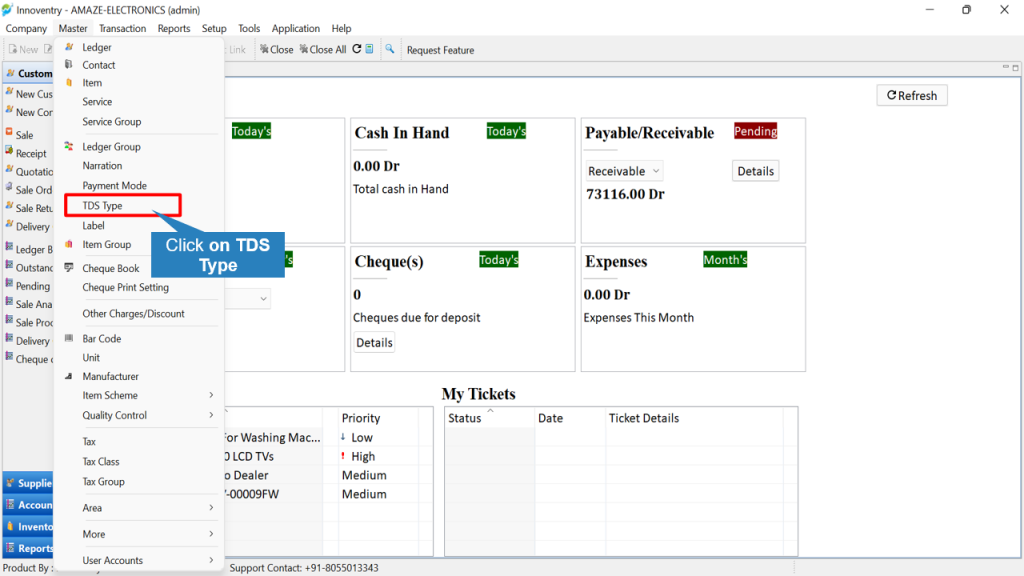

Step 3: Click on the “Master” menu and select “TDS Type” option.

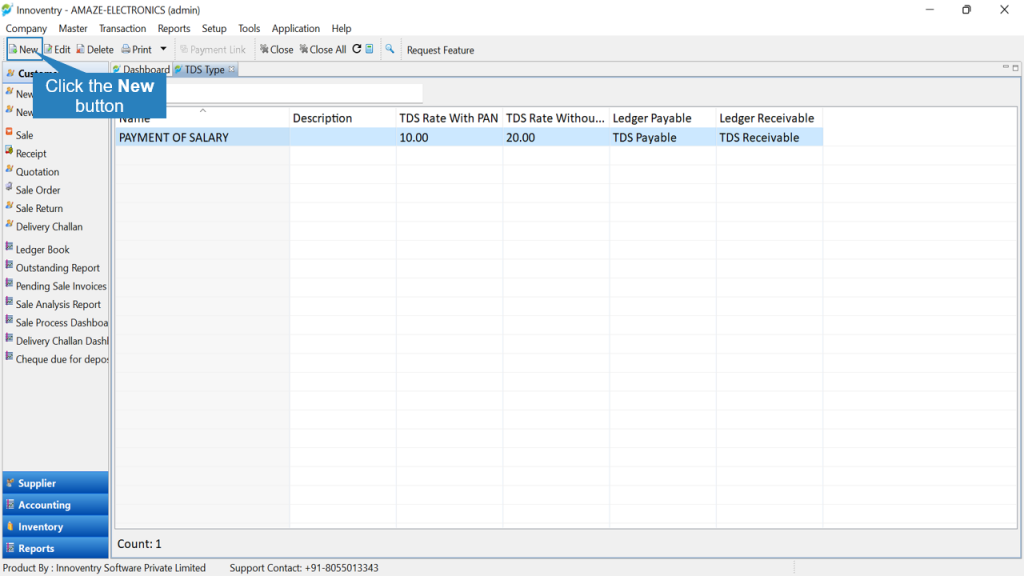

Step 4: The “TDS Type” dashboard opens. Here the user can create the various TDS types required by the business. Click on the “New” option.

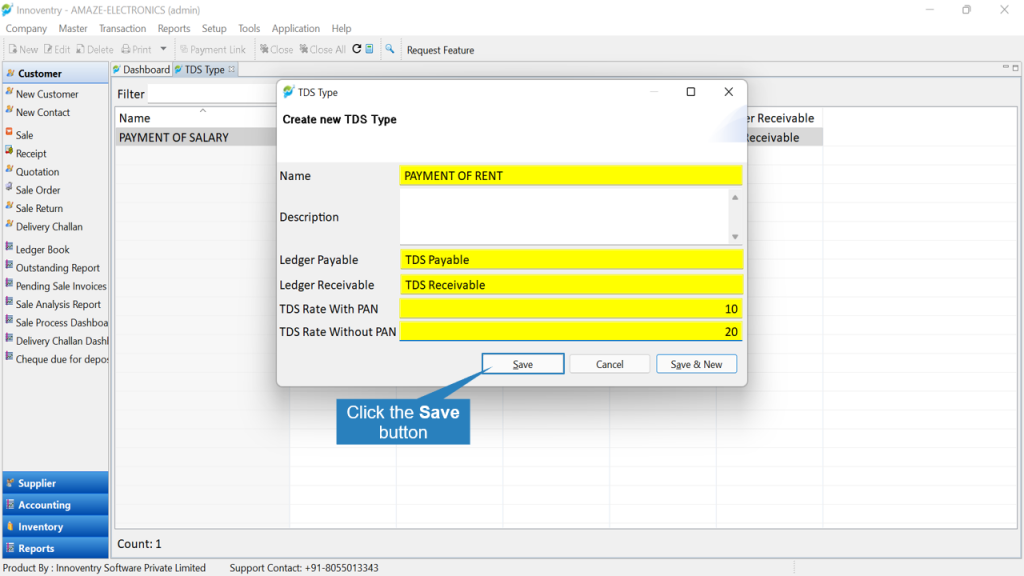

Step 5: Type in the description of the TDS Type. For example, “Payment of Rent” or “Payment of Salary” or any other if required. The user can then feed in the TDS Rates for “With PAN” and “Without PAN” category. After putting in all the information click on the “Save” option and the TDS Type will be saved.

The TDS rates on various payments defined by the Govt. of India can be downloaded through this link.

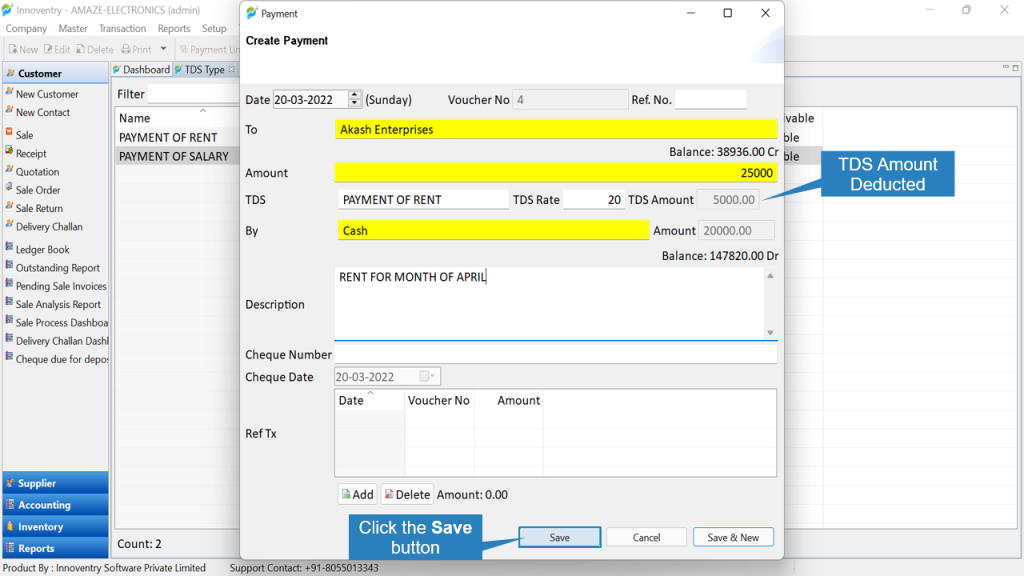

Step 6: When we create payment now, for example “Payment of Rent” the TDS amount is already deducted after selecting the TDS Type in the “Create Payment” dialog box. In the foregoing example, 20% is taken as the TDS Amount is selected of “Without PAN” category as the ledger Akash Enterprise PAN is not registered on the software. If the PAN was registered the software would have automatically taken as 10% TDS.